Converting Change into Opportunity :

How TOPPAN is Serving Asia’s Packaging Needs

In Japan and Asia, TOPPAN works as a converter, manufacturing and filling packages for food, beverage and toiletry manufacturers. Changing lifestyles in the region hold out the possibility of rapid growth.

Japan is the promised land of convenience. In 2018 the country had almost 56,000 convenience stores, which generated sales of just under $100 billion and served a cumulative 17 billion customers, according to the Japan Franchise Association. In the same year, Japanese author Sayaka Murata’s novel Convenience Store Woman—a satire about a woman finding meaning in life through her work as a convenience-store clerk—became a critical and commercial hit on both sides of the Atlantic.

Convenience Store Nation

Japan Facts and Figures

-

Convenience stores(Number) -

Single households(Percentage) -

Convenience store sales(annual) -

Shipment valuePackaging & containers

Central as they are to Japanese life, convenience stores are also a lead indicator of social change. Japanese society is getting older and the birthrate is falling. Convenience stores, which pride themselves on precisely meeting customer needs, are giving that market what it wants. With an aging population (one quarter of Japan’s population is already over 65) appetites decline, so convenience stores now sell food in smaller packages. And with single-person households representing the largest group at an estimated 35% of all households, there is an increasing demand for single-serve ready-made meals.

Modern retail moves into Asia

As Asia’s economy expands, the same economic and demographic trends are starting to become visible in Asia too. Traditional mom-and-pop stores and food stalls are giving way to convenience stores and supermarkets selling packaged goods. Japan’s “Big Three” convenience store brands are major players in the region. In Thailand, for example, 7-Eleven has just under 11,000 stores while FamilyMart has just over 1,100.

According to Masahiko Tatewaki,head of TOPPAN’s global packaging division, consumer habits switch at a very specific point of economic development. “It happens when per capita GDP passes the $3,500 mark,” he says. “That’s when people can buy a motorbike, stop frequenting the local mom and pop store and start driving to supermarkets and convenience stores to buy things. The resulting lifestyle changes drive the growth of our business.”

For TOPPAN, that business is manufacturing flexible packaging and folding cartons, principally for fast-moving consumer goods like food, beverages and toiletries. In Asia, TOPPAN currently has two packaging plants in Thailand, one in China, and two in Indonesia. Tellingly, Thailand’s per capita GDP passed the $3,500 mark in 2007, China’s in 2008 and Indonesia’s in 2011.

Local partner strategy

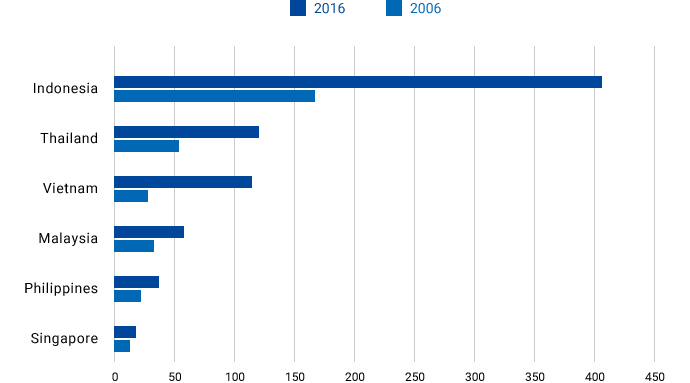

As Asia grows richer, TOPPAN has been aggressively building up its presence there. The company has had subsidiaries in Indonesia and Thailand since 1973 and 1990 respectively, but made a couple of major deals in the two countries in 2017. In April that year, it teamed up with Japanese trading company Itochu to take a 10.7% stake in TPN Food Packaging, a specialist manufacturer of flexible packaging in Thailand. That was followed in August by a tie-up with Karya Wira Investama Lestari , one of Indonesia’s leading packaging companies. Combined with its existing operations, this investment catapulted TOPPAN to become Indonesia’s largest producer of packaging materials.

TOPPAN needs local partners to stay ahead of the competition in Asia’s fast-changing markets. According to Tatewaki, the two sides’ strengths complement one another. “The local companies have personal networks, a local sales force and insights into the local market, not to mention a better grasp of local regulations than us. What TOPPAN brings to the table is our expertise in technology and manufacturing,” he says.

Southeast Asia’s packing material market (in billions of yen)

Why did TOPPAN choose Thailand and Indonesia to expand into? In Indonesia’s case, it’s all about size. With over 260 million people, Indonesia is the world’s fourth most populous nation, with a proportionately large market for packaging materials. Thailand’s case is different: There the country’s 69 million domestic consumers are not TOPPAN’s only target. With its nickname of “the world’s kitchen,” Thailand has one of South-East Asia’s most advanced food processing industries. Home to an estimated 10,000 plus food and beverage processing factories, food is the country’s third-largest industry and Thailand is a major exporter of canned tuna, frozen shrimp, poultry, sugar, and pineapples.

Reverse imports? How convenient

That is why an increasing share of the ready-to-eat packaged meat and fish dishes sold in Japanese convenience stores originate in Thailand. TOPPAN affiliate TPN Food Packaging manufactures these packages which are then filled and shipped to Japan by a food processor. Tatewaki points out that as Japan’s domestic labor force shrinks, more food-processing operations will probably take place outside the country.

But serving Asian domestic markets and exporting filled packages to Japan is only half of TOPPAN’s growth strategy as a converter. “How can we expand the business going forward?” asks Tatewaki rhetorically. “Through being environmentally responsible.” In TOPPAN’s case, the company is tackling the sustainability challenge by exploring the development of mono-material packages—packages made of a single material can be recycled as they are; packages made of layers of different material cannot—and looking into the practicable recycling systems that different companies are trying to set up. “There is a lot going on under the surface,” Tatewaki concludes.