GovernanceCorporate Governance

Basic ApproachBack to Top

Effective corporate governance serves as an integral foundation for TOPPAN to achieve sustainable growth and medium-to-long-term increases in corporate value. We have formulated a Basic Policy on Corporate Governance to clarify the basic approach and framework for corporate governance based on a full understanding of the principles and aims of the Corporate Governance Code established by the Tokyo Stock Exchange. The basic policy was partially revised in June 2023 to reinforce an efficient style of governance that encompasses diversity & inclusion and SDGs initiatives.

Our management is consolidated under two regulations prescribed for the advancement of fair management throughout the Group: Related Company Administration Regulations and Related Company Administrative Regulations for Overseas. TOPPAN seeks to maximize the value of the entire Group through this governance-focused approach.

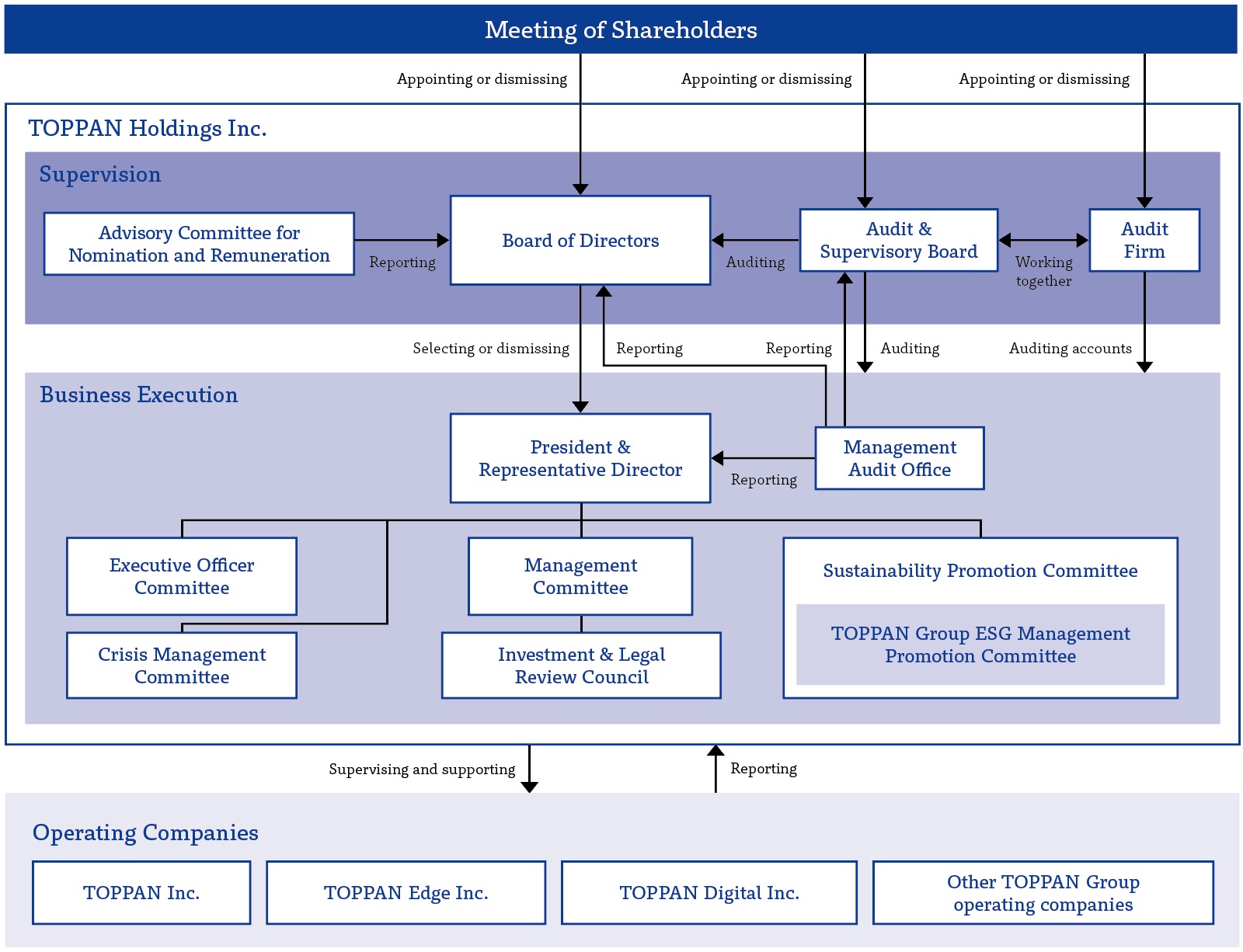

Corporate Governance Structure at TOPPAN Holdings Inc. (as of September 30, 2024)

Promotion Framework (as of June 27, 2024)Back to Top

The TOPPAN Holdings Inc. governance structure employs an Audit & Supervisory Board. The Board of Directors strives for sustainable growth and medium-to-long-term increases in corporate value while overseeing important managerial decision-making and the execution of directors’ duties. An Audit & Supervisory Board composed of a majority of independent external members audits the execution of directors’ duties from a position independent of management. The Advisory Committee for the Nomination and Remuneration of Directors enhances the objectivity and transparency of personnel affairs and remuneration of directors.

Management in the holding company structure is consolidated under two regulations for fair Group management: Related Company Administration Regulations and Related Company Administrative Regulations for Overseas. We seek to maximize the value of the Group through this governance-focused approach.

Board of Directors

TOPPAN Holdings’ Articles of Incorporation stipulate that directors shall number no more than 15 and resolutions for their appointment shall be adopted by a majority of the votes of attending shareholders holding one-third or more of the voting rights of the shareholders authorized to vote. The Board of Directors comprises six internal and three external directors (as of June 27, 2024). Based on a resolution of the Board of April 27, 2016, TOPPAN Holdings introduced an executive officer system for a flexible management framework that responds rapidly and precisely to shifts in the business environment. This also aims to further clarify the authority and responsibilities of officers. In addition to executive officers concurrently serving as directors, there are 17 executive officers not serving as directors.

Ordinary Board meetings are held monthly to make decisions in accordance with the Regulations of the Board of Directors, receive reports from directors, and supervise business execution. The Board also holds extraordinary meetings when urgent matters arise. Eighteen Board meetings were held in fiscal 2023. Under the Board’s regulations, it discussed various Group management issues, priority issues in core businesses, and matters related to important business execution.

Main Topics in Fiscal 2023

- Group synergies with the transition to a holding company structure

- Progress of the Medium Term Plan

For sustainability, a theme of particular interest to stakeholders, the Sustainability Promotion Committee discusses issues while the Board makes resolutions on key indicators for initiatives. The Board also deliberates resolutions on matters stipulated by laws and regulations and the Articles of Incorporation, receives reports on legislative matters and the execution of important businesses, and strictly supervises the execution of duties. Sufficient time for Q&A has been scheduled for Board meetings. The results of the fiscal 2023 meetings are as follows.

| No. of Meetings Held | Average Attendance | Average Duration | Average No. of Agendas |

|---|---|---|---|

| 18 | 99.2% | 1 hour and 59 min. / meeting |

11.3 bills / meeting |

Before each Board meeting, external directors receive a summary and key points of the agendas. Questions and opinions received in advance are raised at meetings to stimulate deliberations.

Especially important matters for the Board are deliberated beforehand by the Management Committee, a body made up of directors and other officers nominated by the president & representative director. The committee prioritizes managerial efficiency in decision-making. Twenty-one committee meetings were held in fiscal 2023.

Audit & Supervisory Board Meetings

TOPPAN Holdings engages five audit & supervisory board members, three of whom are external. Based on audit standards set by the Audit & Supervisory Board, members also attend all Board of Directors and Management Committee meetings, and other important meetings on risk management. Members systematically audit operational sites and related companies in close cooperation with the audit firm and internal audit departments. Board members audit and advise the Company from a preventive perspective to ensure legality of the operations of directors and departments and smooth and appropriate management in line with in-house policies and rules.

Audit & supervisory board meetings are held monthly and extraordinary meetings are held as necessary. Fifteen meetings were held in fiscal 2023. The average duration was 1 hour and 37 minutes. In fiscal 2023, the board focused on legal procedures and the Group’s structure in association with the transition to a holding company structure and audited progress made in reinforcing Group governance and synergies across operating companies.

The priority audit themes in fiscal 2023 are listed below.

- Progress in ESG management through Sustainability Promotion Committee attendance

- Internal control associated with core system updates

- Compliance with the Subcontract Law of Japan

- Onsite inspections of overseas subsidiaries

Advisory Committee for the Nomination and Remuneration of Directors

TOPPAN Holdings has an Advisory Committee for the Nomination and Remuneration of Directors, pursuant to a resolution of the Board of Directors of May 26, 2016. The committee aims to enhance the transparency and objectivity of decision-making on nomination and remuneration. It includes external directors meeting the requirements of our Independence Standards for External Officers, and we ensure that they outnumber the number of internal directors and audit & supervisory board members on the committee. External audit & supervisory board members meeting the independence standards can also be added. As of June 27, 2024, the advisory committee has two internal directors, three independent external directors, and one independent external audit & supervisory board member. It examines proposals from the Company on the nomination and remuneration of directors (including representative directors) and provides recommendations to which the Board of Directors or persons entrusted by the Board refer when deciding on the proposals.

The committee convened twice in fiscal 2023. Members discussed the upcoming composition of the directors and audit & supervisory board members after June 2023, reviewing personal histories and reasons for selection. Remuneration of officers was also reviewed by referring to performance evaluations of relevant businesses.

Internal Audits

TOPPAN Holdings’ Management Audit Office is independent from business departments. It audits the management and operations of sites and plants, including consolidated subsidiaries. Twenty-six personnel engage in audits, as of March 31, 2024. Management audits verify and evaluate the consistency of management processes with targets and confirm necessary-and-sufficient risk control. Operation audits verify and evaluate mechanisms for prevention of misconduct and compliance with relevant laws, regulations, and in-house rules. They also confirm efficient and accurate execution of operations. Based on operation audit results, the office makes recommendations for improvement whenever necessary. The results of management and operation audits are reported directly to representative directors, the Board of Directors, the Audit & Supervisory Board, and relevant directors in Group companies.

Approach to Promotion FrameworkBack to Top

External Officers

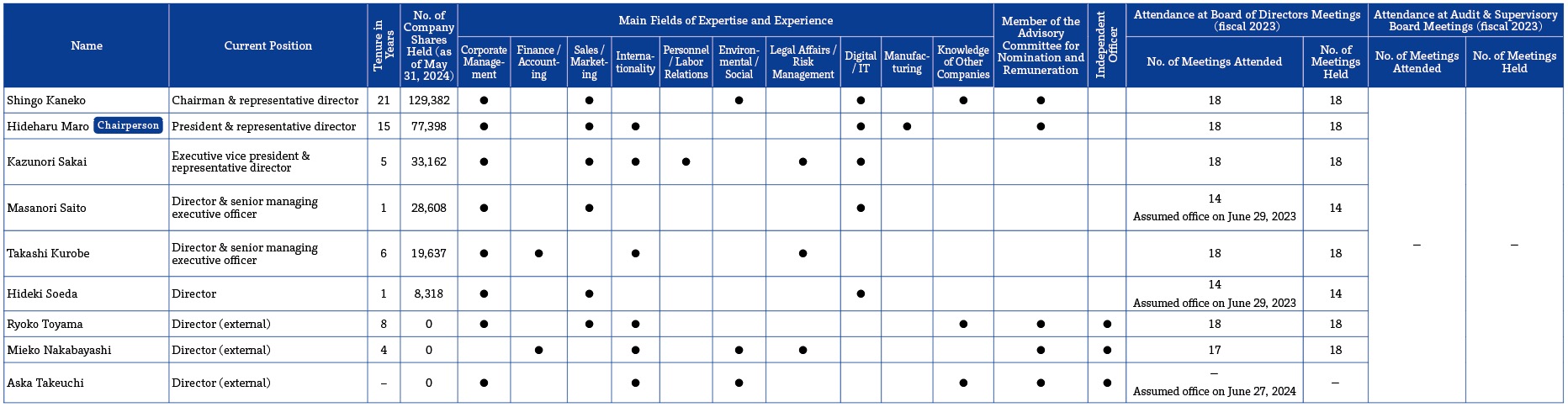

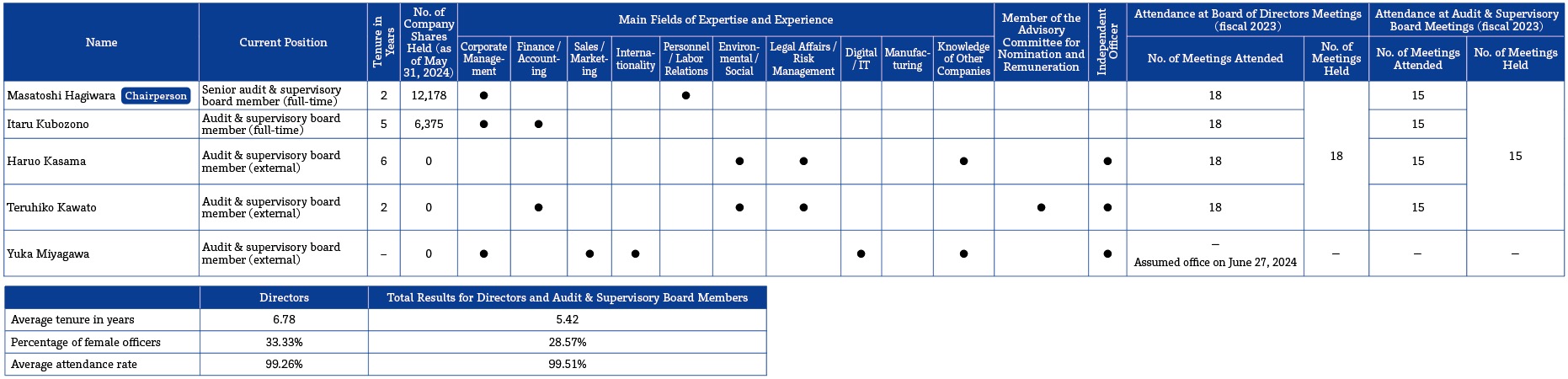

External directors and audit & supervisory board members with a high degree of independence are critical for sound governance. Three external directors and three external audit & supervisory board members with sufficient independence are therefore appointed. We have confirmed that none of them are major shareholders or stakeholders of the Company, receive monetary amounts or other assets from the Company apart from their remuneration as officers, or bear any responsibility for the execution of the operations of any of the Company’s major business partners.

We clarified our standards for assessing the independence of external officers by establishing Independence Standards for External Officers through a resolution of the Board of Directors passed on November 26, 2015. The Company also assesses independence based on the standards of the Tokyo Stock Exchange (TSE). Details on the independence standards are available on the corporate website (appendix to Basic Policy on Corporate Governance). TOPPAN Holdings’ external directors (Ryoko Toyama, Mieko Nakabayashi, and Aska Takeuchi) and external audit & supervisory board members (Haruo Kasama, Teruhiko Kawato, and Yuka Miyagawa) are independent officers pursuant to the TSE standards.

A support system for external officers has been established. External directors exchange information and opinions with other directors, and the president’s office provides them with necessary internal and external information. External audit & supervisory board members receive internal and external information from other members and dedicated personnel, and share information and exchange opinions with each other.

Diversity in the Board of Directors

To enhance the Group’s corporate value, TOPPAN Holdings defines the expertise, experience, and insight required for Board membership and selects candidates who meet the criteria and can fulfill fiduciary responsibilities to shareholders. The Board composition also ensures diversity primarily in age, gender, and nationality. The number of directors is necessary and sufficient for a structure making each director responsible for management. A skill matrix of directors is shown below.

Executive Positions in Other Companies

Concurrent executive positions held in other listed companies by directors and audit & supervisory board members are presented in business reports, reference documents for shareholder meetings, etc.

Directors and Audit & Supervisory Board Members at TOPPAN Holdings Inc. (as of June 27, 2024)Back to Top

Remuneration Paid to OfficersBack to Top

Please see the Corporate Governance section of our Integrated Report for details on the remuneration paid to officers, the method used to determine that remuneration, etc.

Board AdministrationBack to Top

Assessing the Effectiveness of the Board of Directors

Assessment Process

To ensure that the Board of Directors executes duties appropriately and effectively, the Basic Policy on Corporate Governance at TOPPAN Holdings Inc. calls for an annual analysis and evaluation of the effectiveness of the Board and the disclosure of a summary of results. The fiscal 2023 results follow below. Starting from fiscal 2022, TOPPAN has been asking an external organization to design, analyze, and evaluate the questionnaire in order to

secure objectivity in the analysis and evaluation.

Improvement Initiatives based on Previous Assessment

Based on the results of the fiscal 2022 assessment, the Board strove to improve on the following matters:

- 1)

- deliberation on the roles the Board is to play during the transition to a holding company structure and the design of an effective operational method for selecting agendas, etc.

- 2)

- enhanced monitoring of the Groupwide risk management framework as a safeguard to secure globalized operations aiming at the sustainable growth of the Group.

In commenting on the outcomes of those efforts, several officers expressed favorable views on the smooth operations of the Board during and after the transition to a holding company structure. In addition, some officers offered constructive suggestions on how the Board could operate still more effectively. We reiterated the need to continuously confirm how the company structure should ideally function and how management agility should be secured at each operating company.

Achievements and Challenges

The effective functioning of the Board was confirmed. In particular, the officers highly evaluated the constructive discussions the Board achieved by engaging independent external officers with expertise in a diversity of fields, and the Board’s involvement in Group initiatives addressing sustainability issues. To activate deliberations for improved effectiveness of the Board, the fiscal 2023 assessment also identified two key

improvements that will be required to accommodate the widening scope of TOPPAN’s businesses: an upgrade of the meeting materials provided to the Board and further efforts to deepen the independent external officers’ understanding of the businesses. Recognizing the importance of these issues, we will implement measures to further improve the effectiveness of the Board functions.

Training for Officers

TOPPAN Holdings Inc. has systematically organized regular training for directors on approaches to be taken in addressing the managerial issues facing TOPPAN. The directors hone their management skills through frank dialogue. New director candidates also receive training focused on managerial issues, financial literacy, the legal responsibilities of directors, and relevant rules and regulations. Audit & supervisory board members, meanwhile, are working to understand the characteristics of the diverse businesses of TOPPAN and to expand their own auditing functions by gathering information, visiting Group sites, and participating in training courses held by external organizations.

Succession PlanningBack to Top

Based on the management philosophy and strategy, the Board of Directors regards the following to be integral decisions for the sustainable growth of TOPPAN and the medium-to-long term enhancement of the corporate value of the Group: 1) selection of representative directors, the CEO, and other senior managers and 2) strategies to foster their successors. The Board has been implementing a succession plan with the objectives shown below.

Objectives of Succession Planning

- Maintaining and enhancing organizational competitiveness by systematically developing human assets to be assigned to important posts (posts requiring personnel with considerable experience and competency)

- Pooling leadership candidates to swiftly allocate human assets who can address shifts in the business environment

- Promptly appointing successors when important posts are vacated due to unforeseen circumstances

- Enhancing the awareness of senior managers regarding the development of successors

- Formulating a concrete succession plan in alignment with TSE’s Corporate Governance Code, and integrating the plan with TOPPAN’s initiatives for reinforced governance across the Group

We will work to achieve sustainable corporate growth and management stability through these initiatives.